Home Blog

Pacific nation hosts its biggest-ever election day

Ballots are due to be cast in one of the Pacific’s largest elections as Solomon Islanders, from the city to remote villages, choose their next national leaders.

About 350,000 people are due to vote across 50 seats on Wednesday, a nationwide public holiday.

For the first time, the national vote also coincides with elections for eight of the 10 local governments.

Families...

IRENA Director General urges stronger partnerships for Sustainable Energy future in SIDS

The Director General of the International Renewable Energy Agency (IRENA) Tuesday emphasised the need for strong partnerships to accelerate progress towards a resilient and sustainable energy future.

In his address at the Small Islands Developing States (SIDS) Ministerial in Abu Dhabi as part of the 14th Session of the IRENA Assembly, Francesco La Camera said, “The progress made by SIDS...

SIDS Chair calls for action on energy transition and climate resilience

Barbados Minister of Energy and Chair of the SIDS Ministerial at the 14th IRENA Assembly, Lisa Cummins Tuesday highlighted the significance of recent developments in climate action and energy transition during the outcome of the COP28 summit in Dubai last year.

This high-level event was convened under the theme of “Charting a Resilient and Sustainable Energy Future for SIDS”.

“Coming out...

IRENA DG urges lawmakers to accelerate renewable energy transition

The Director General of the International Renewable Energy Agency (IRENA) Francesco La Camera has stressed to lawmakers the urgent need for collective action to combat climate change through renewable energy expansion.

“Your presence today exemplifies the global commitment to combat climate change through the rapid expansion of renewable energy, a commitment we must reinforce with decisive and collective action.

“The urgency...

Ministers and energy leaders to advance energy transition and ensure UAE Consensus moves towards implementation

The International Renewable Energy Agency’s (IRENA) 14th Assembly kicked off Tuesday in Abu Dhabi, from 16-18 April 2024.

The meetings, presided over by Rwanda, gather more than 1,300 participants from 144 countries, including Ministers, industry leaders, and CEOs to chart a strategic way forward across countries, regions, and the world, in light of the findings of the first Global Stocktake...

Optimising the role of public finance will advance universal energy access

The world has only seven years left to achieve the Sustainable Development Goals (SDG).

Together with other custodian agencies of the goal seven – to ensure access to affordable, reliable, sustainable and modern energy – the International Renewable Energy Agency (IRENA) has been annually tracking the progress towards the goal’s achievement, specifically the progress of the international financial flows to...

With One Voice, Small Island Developing States build bridges for a Sustainable Energy Future

Expert Insight by: Arieta Gonelevu Rakai, Regional Programme Officer, Islands, IRENA

Considering the deepening global climate crisis, the urgent call for action to accelerate energy transition from Small Island Developing States (SIDS) has grown louder, especially since they are most vulnerable to the impacts of climate change. Tapping into the rich potential of the small island states’ diverse renewable...

The 2024 IRENA Youth Forum ensures Young People are equipped to lead a Sustainable Energy future

The 2024 edition of the International Renewable Energy Agency (IRENA) Youth Forum, themed ‘Youth at the Core of a Just Energy Transition: Skills, Empowerment and Innovation', aimed to not only foster discussions but also equip young participants with the tools and knowledge necessary to shape a more sustainable and inclusive energy future.

Through a series of engaging activities that include...

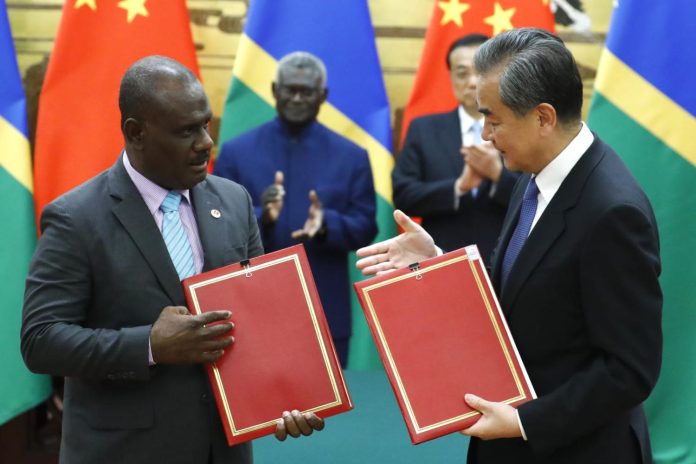

Is there a hidden cost of China’s Pacific play?

By Teuku Riefky, Mohamad Dian Revindo, Universitas Indonesia

Solomon Islands host crucial elections keenly watched from Beijing to Washington, but only China is putting its money where its mouth is in the region and it’s working.

China’s investment in the Pacific has redrawn the political map of the region.

Since 2008, the Chinese government has committed over US$9 billion to infrastructure, development,...

Your quick guide to the Solomon Islands elections

By Priestley Habru, University of Adelaide and 360info Staff

Prime Minister Manasseh Sogavare could retain power on April 17, but who stands in his way of making history?

Solomon Islands sits on the edge of a monumental moment.

Solomon Islands writer Dr Tarcisius Kabutaulaka called the April 17 election “perhaps the most important to the Solomon Islands since independence.” If you monitor...