Home Blog

‘The right person’: What did Solomon Islanders vote for?

After a relatively well-organised and peaceful day of voting in Solomon Islands, the electoral commission is working with donor partners to safely transport ballot boxes from polling stations all over the country to centrally located counting venues.

It is a massive exercise with over 200 New Zealand Defence Force personnel providing logistical support across the 29,000 square kilometre sprawling island...

IRENA Assembly President urges global action for renewable energy transition

The President of the 14th IRENA Assembly and Rwanda Minister of Infrastructure, Jimmy Gasore, has recognised the historic progress achieved at COP28 through the UAE Consensus.

Presiding over the International Renewable Energy Agency (IRENA) Assembly Wednesday, Gasore emphasised the importance of transitioning away from fossil fuels in a just and equitable manner, along with the call to triple renewables and...

IRENA DG urges accelerated action towards renewable energy goals

The Director General of IRENA, Francesco La Camera has told the opening session of the 14th International Renewable Energy Agency (IRENA) Assembly in Abu Dhabi that countries must transition away from fossil fuels.

“COP 28 has delivered this message clearly, recognising the imperative of tripling renewables and doubling efficiency by 2030, while transitioning away from fossil fuels.

“Let me recognise the...

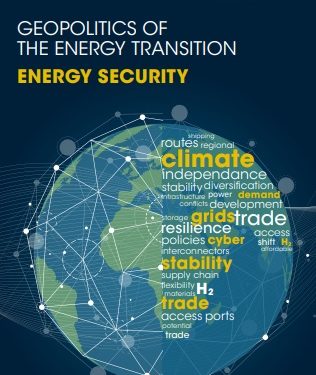

Ministerial roundtable emphasises renewable energy’s role in shaping global energy security landscape

A new report released Wednesday by the International Renewable Energy Agency (IRENA), highlights the shift towards renewable energy as a means to bolster energy independence.

It emphasises that while traditional geopolitical factors like market manipulation and infrastructure disruptions still matter, their influence is likely to decrease in a renewable energy-focused context.

The report suggests that transitioning to electrification and increasing reliance...

Calls on the World to expedite the delivery of renewable energy

The Global Renewables Alliance (GRA) has called on the world to expedite the delivery of renewable energy, in line with the commitments made at COP28 last year, which aimed to triple global renewable capacity to over 11,000 gigawatts.

This week the ‘Global Time for Action’ campaign was launched on the sidelines of the 14th International Renewable Energy Agency (IRENA) Assembly...

Tonga unveils Pacific Islands Forum theme, as other Pacific territories’ membership blocked

It could be confused with a political campaign slogan, but this year’s theme for the 53rd Pacific Islands Forum is: Transformative, Resilient, Pasifiki: Build Better Now.

The theme was launched in Tonga last week, as the Kingdom prepares to host regional leaders and their delegations in August.

Tonga’s Prime Minister Hu’akavameiliku Siaosi Sovaleni will chair the forum, saying this year is...

Transition to renewables calls for new approach to energy security

Evolving concept of energy security must address energy demand, system flexibility, technology access and infrastructure development, says IRENA

The transition away from fossil fuels to renewables requires a new interpretation of the concept of energy security, according to a new report by the International Renewable Energy Agency (IRENA) published Wednesday.

Geopolitics of the energy transition: Energy security outlines a multi-dimensional energy...

Perhaps the numbers aren’t looking so good for Sogavare in the Solomons

By Terence Wood

Who will emerge as prime minister from Wednesday’s elections in Solomon Islands? The prime minister doesn’t shape policy in Solomons as much as some commentators suggest. Prime ministers there are largely prisoners of political economy. Still, as I wrote on 4 April, exactly who emerges on top after the election still has some importance. The prime...

Pacific nation hosts its biggest-ever election day

Ballots are due to be cast in one of the Pacific’s largest elections as Solomon Islanders, from the city to remote villages, choose their next national leaders.

About 350,000 people are due to vote across 50 seats on Wednesday, a nationwide public holiday.

For the first time, the national vote also coincides with elections for eight of the 10 local governments.

Families...

IRENA Director General urges stronger partnerships for Sustainable Energy future in SIDS

The Director General of the International Renewable Energy Agency (IRENA) Tuesday emphasised the need for strong partnerships to accelerate progress towards a resilient and sustainable energy future.

In his address at the Small Islands Developing States (SIDS) Ministerial in Abu Dhabi as part of the 14th Session of the IRENA Assembly, Francesco La Camera said, “The progress made by SIDS...